Retained Ownership and Feeder Basis

Editor’s note: Markets appear favorable for retained ownership of calves this year. By retaining ownership, producers can reap the benefits of a genetic selection program and other investments made in calves, such as the use of low-stress weaning techniques. Risk management is advised to producers that retain ownership.

Read on for details of the economics in an article written by Brian Perillat, Canfax Manager/Senior Analyst, which originally appeared in the October 4, 2013 issue of the Canfax Weekly Market Outlook and Analysis (available to Canfax subscribers). It is reprinted with permission.

Remarque : cette page web n’est actuellement disponible qu’en anglais.

Although calf and feeder prices have been quite strong so far this fall, generally $5-$15/cwt stronger than a year ago, a bullish tone in the cattle futures markets and a bearish tone in the feed market has producers looking at the opportunity to background or retain ownership of their calves.

With any venture of feeding calves, whether they are bought or raised, the potential rewards must be weighed against the risks, while keeping in mind that strategies exist to reduce overall risk exposure.

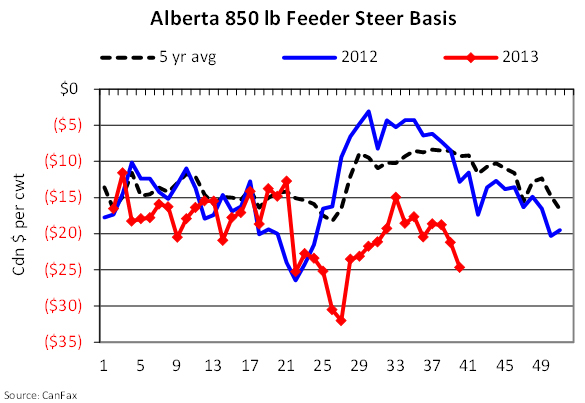

Both the Live Cattle and Feeder futures have been improving recently, with the feeder futures hitting record highs on the back of strong live cattle futures and weaker corn futures. Despite the strong US markets, Canadian feeder prices have been relatively flat as uncertainty around the new Country of Origin rules which are to come into effect November 23, 2013, linger over the Canadian market. This has resulted in very disappointing basis levels, especially since September is often the time of year when the Canadian feeder cash to futures basis should seasonally be at its strongest level. The current basis is -$24.67, which is about $12/cwt weaker than last year, and $15/cwt weaker than the 5 year average. This is the weakest basis level for this same week since 2004.

It is also worth noting that the US feeder basis has been quite weak this year at times, and this summer was as much as -$12/cwt which distorts the Canadian basis picture somewhat. That said, the weak September basis is much more related to Canadian market issues than US basis levels. Moving forward, although the US feeder futures remain very strong, we have to remain cautious as the COOL issues could continue to be a factor well into next year. The Canadian basis has been at about -20, and is now -25. If the basis follows the seasonal pattern and remains $10 weaker than the 5 year average, this could mean a basis of -25 or slightly worse next spring, and is a trend worth monitoring.

For consideration in retained ownership, the value of the calves, cost of gain, expected selling price, and risk management must be factored in. The target market is also an important factor, as that can affect cost of gain, the marketing window, as well as the associated basis levels and expected selling prices. For example, calves lightly backgrounded for a grass program are significantly different than calves backgrounded for a finishing feedlot.

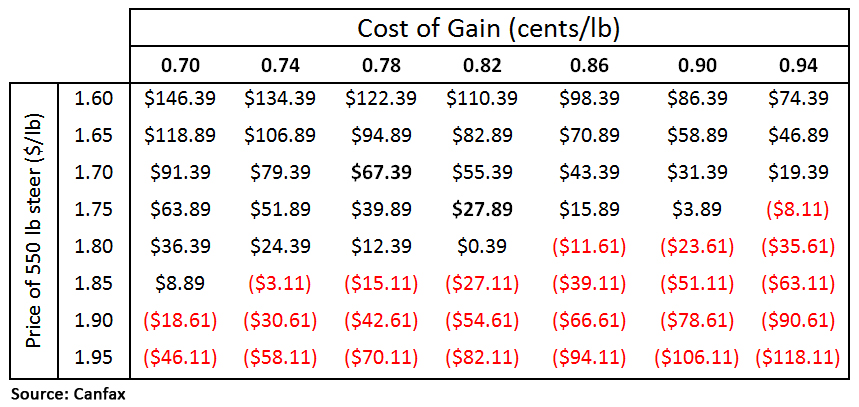

The following scenario uses current market information by taking a 550 lbs steer backgrounded to gain 2 lbs a day and marketed in March at 850 lbs. Using a March feeder futures of $164.475 and a March Canadian dollar of .9649, and a basis of -25, this gives us a projected selling price of $145.46/cwt. Therefore depending on the current value of the calves and cost of gain, a profitability matrix is attached.

This chart shows that if the 550 lb steer is worth $1.75/lb today, and the cost of gain of backgrounding is $0.82/lb there is a potential profit of $27.89/hd. While if the price was $1.70/lb and cost of gain was $0.78, this would give a profit of $67.39/hd, for retained ownership.

As discussed, there is still significant risk in basis and price level changes. Although several risk management strategies exist, some of the more simple options may be to contract with a feedlot, or for Alberta producers to use CPIP which currently has coverage for 850 lb steers in March at $148/cwt less a premium of about $2.40/cwt. This leaves producers with a floor price very near the price used in the above profitability matrix.

Learn more

Fed Cattle Basis

BeefResearch.ca

Retained Ownership: Discussion and Alternatives

Beef Cattle Handbook

Click here to subscribe to the BCRC Blog and receive email notifications when new content is posted.

The sharing or reprinting of BCRC Blog articles is welcome and encouraged, however this article requires permission of the original author.

We welcome your questions, comments and suggestions. Contact us directly at info@beefresearch.ca or generate public discussion by posting your thoughts below.