Winter Feed Cost Comparison Calculator – Regional Trends and Opportunities

Remarque : cette page web n’est actuellement disponible qu’en anglais.

Feed prices are driven by supply, demand and the price of alternatives. Winter feed presents the largest variable cost for producers. As producers look for ways to protect margins and minimize losses this fall, there are opportunities to be found in examining low-cost feed alternatives.

While the cost of some inputs cannot be controlled by any one operation, producers can control their budget for high-quality rations. Knowing where a crop may fall short on nutrition is a critical first step, and a feed test will point out where supplementary nutrients may be required for a herd. The next step is sourcing nutrients at the lowest price, choosing from a variety of feedstuff that offer nutrient balance. The Beef Cattle Research Council’s Winter Feed Cost Comparison Calculator is a decision-making tool that helps producers compare the cost of feed alternatives available in their area.

Regional Conditions and Trends to Consider

The calculator can be used to analyze a wide range of feed inputs. It allows producers to consider unique and regionally specific, cost-effective alternatives. When using the tool, simply adjust the labels and pricing to include the feed types and prices applicable to your region. The lowest cost ration will vary based on local conditions and availability, so it’s helpful to explore trends across Canada to translate into savings.

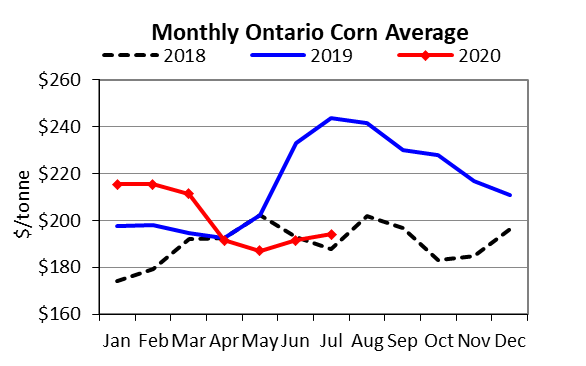

A producer in Ontario is likely familiar with the upward price trend affecting corn the last three years. This year however, Ontario corn is at CDN$193/tonne in July, 21% below last July and within 4% of the five-year average. Analysts predict that prices may decline further still, based on abundant domestic and global stocks. With a late, cool spring, followed by drought, many eastern producers may fall short on hay. Producers may wish to investigate how this change in the price of corn could affect their feed costs this winter.

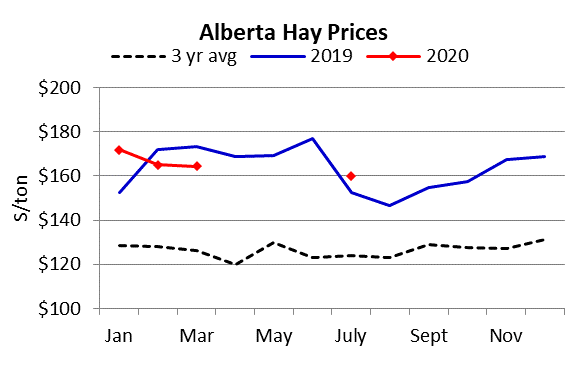

On the Canadian prairies, years of drought have turned around into favourable conditions for pasture, likely to reverse rising trends in the price of hay. Not all regions have been affected equally, however. Depressed yields in 2018 and 2019 moved Alberta hay prices to record highs last June at CDN$177/tonne. This year, tame hay growth in Alberta is rated good to excellent in 93% of cases, a 37 percentage point improvement over the five-year average rating. While an adequate supply of quality forages is expected for Alberta this year, some producers in the north will be delayed managing their crops because of cool, wet weather. We can expect that increased availability and softening demand in southern regions may put pressure on the current price of hay at CDN$160.18/tonne in July. Limited supply and increasing demand in the north may keep hay prices strong. Northern producers may wish to explore low cost alternatives to offset the higher price of hay, where southern producers may wish to balance their rations based on anticipated savings.

While drought conditions eased this spring in Saskatchewan, some pastures have been left in poor condition. Topsoil moisture in some regions has been licked by wind, whereas northern areas are seeing moisture surpluses and flooding. Producers in Saskatchewan have increased their reliance on silage and greenfeed in response to low forage production the last three years. Cooler temperatures well into spring spelled trouble for canola and many producers again reseeded to greenfeed. Forage prices in Saskatchewan are expected to be steady as alternative greenfeed, silage and grain should be readily available.

Producers in Manitoba might prepare to buy more alternatives this year, especially where production, yields and quality of first cuts are below average in the eastern and interlake areas. Manitoba anticipates forage supplies to be tight in most regions, with excessive moisture early in the year presenting a risk of fusarium development and a lack of moisture in the north and central regions in recent weeks limiting growth. Compounding effects on pasture from subsequent years of drought will limit the length of time cattle can be on pasture and contribute to poor hay yields. Low cost alternatives to forage are likely to be in high demand.

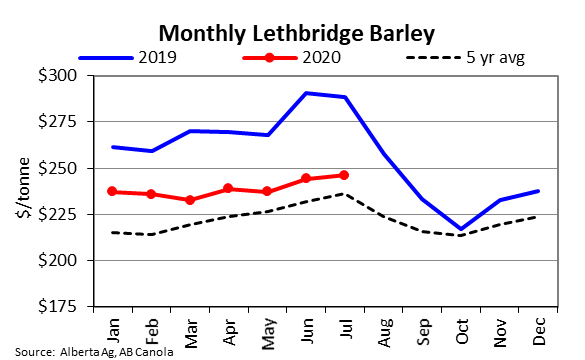

Fortunately, ample supplies of quality alternatives are pressuring the price for those alternatives down. The global and domestic outlook for 2020 and 2021 from Agriculture and Agri-Food Canada’s Outlook for Principle Field Crops report shows an abundant supply of grain stocks putting downward pressure on feed grain prices. For example, global barley production in 2019 broke records: last year’s world production of barley was at its highest levels in 20 years. In July 2020, Lethbridge barley was CDN$246/tonne, 15% below July 2019 but 4% above the five-year average. In a typical year, barley prices seasonally decline into the fall before finding some support in the fourth quarter. As harvest progresses, feed grain prices may decline as supplies are confirmed.

Using the Calculator – A Saskatchewan Example

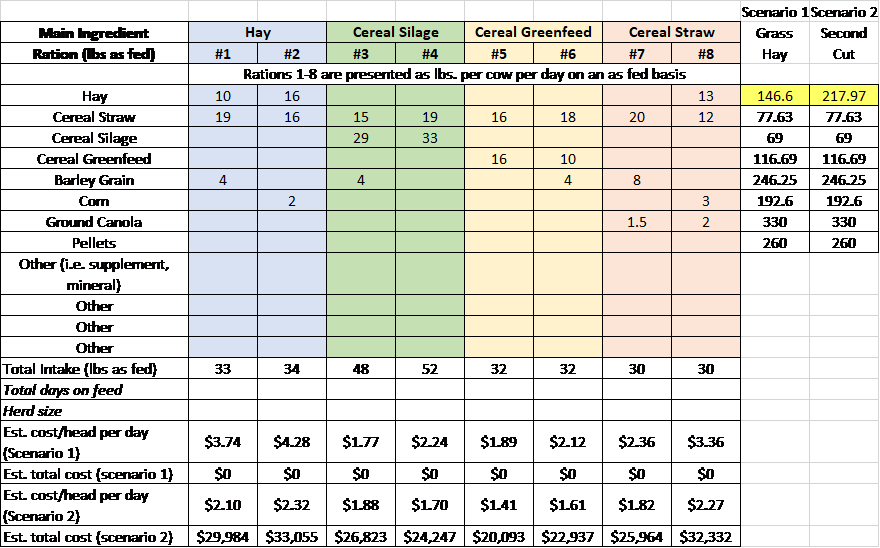

The example below is based on feed rations available on provincial government websites*, estimated for beef cows at 1,400 lbs, mid-pregnancy with a body condition score of three. Prices were estimated using Canfax reporting and the 2020 Winter Forage Market Price Discovery – Saskatchewan (January 2020)

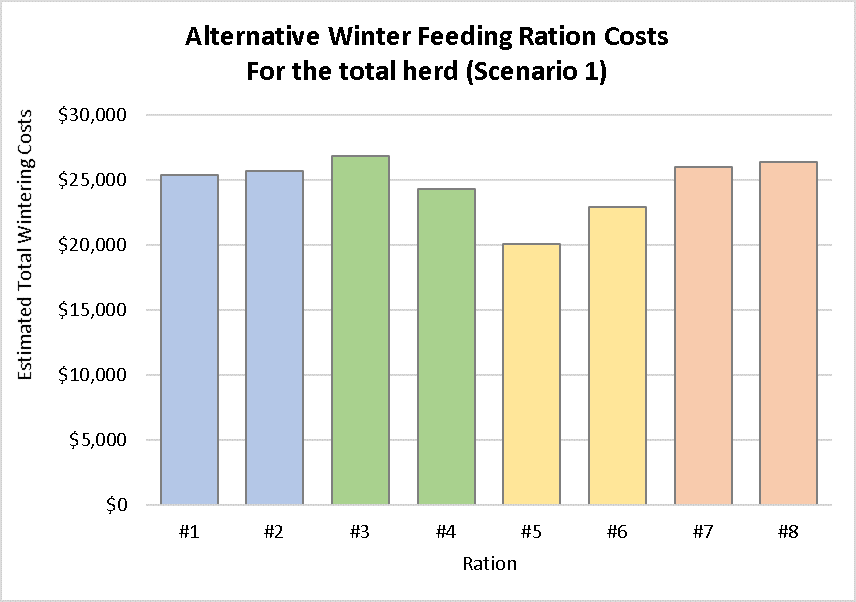

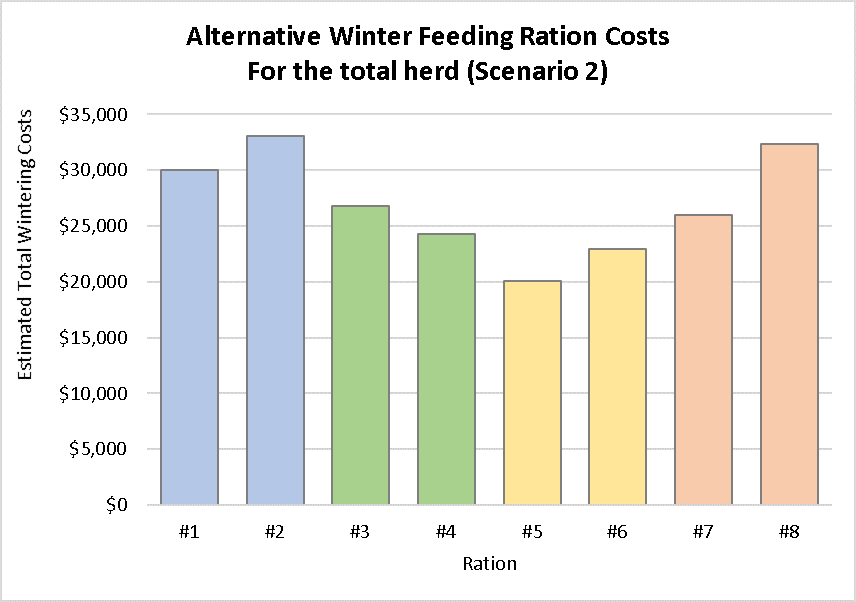

Inputting available feed price estimates, the example in Table 1 below shows that rations based on cereal greenfeed in Saskatchewan would generally cost less than hay, cereal straw or cereal silage-based rations. Based on a 150 head herd, fed for 95 days, Scenario 1 shows that a cereal greenfeed-based ration could save producers over 20% this winter, or $5,279 when compared to a grass hay-based ration. Scenario 2 compares a primarily cereal greenfeed ration with a second cut alfalfa-based hay ration and shows producer savings of 33% and nearly $10,000. Research has shown that further cost savings can be achieved through extended grazing, where possible. Producers can investigate how extended grazing could impact costs for their own operation, changing the days on feed and the required ration balance in the calculator.

Table 1 – A Saskatchewan Example

* Ration examples and nutrient values of feed sourced from Saskatchewan Agriculture winter feeding guidelines.

Combined with feed testing and a robust knowledge of nutrient requirements, the Winter Feed Cost Comparison Calculator decision-making tool is designed to help producers tailor their rations to shed waste through the winter and emerge lean and green in the spring.

Le partage ou la réimpression des articles du blog du BCRC est bienvenu et et encouragé. Veuillez mentionner le Conseil de recherche sur les bovins de boucherie, indiquer l’adresse du site web, www.BeefResearch.ca/fr, et nous faire savoir que vous avez choisi de partager l’article en nous envoyant un courriel à l’adresse info@beefresearch.ca.

Vos questions, commentaires et suggestions sont les bienvenus. Contactez-nous directement ou suscitez une discussion publique en publiant vos réflexions ci-dessous.